Realtors lack math skillz

Loan Mod Vs Walking away

I get asked on a regular basis about what I think of walking away from a house. 10 or 15 years years ago I had a different opinion than I have now. Back then I thought it was a cop-out, a terrible thing to do. I don't think that any more. Now I'm much more of a realist. My opinion is that you should do what ever is best for you and your family (as long as it's legal and walking away is in most cases).

From a financial standpoint, in today's market, walking away is going to be a much better choice than a loan mod for most families in the IE. A loan mod might make more sense if the home in question is only slightly underwater but that's hardly the case with most IE homes purchased in the last 6 or 7 years.

In the last real estate bust I stayed put while many of my friends walked away. I was never very far underwater though. However I would have liked to have moved in the mid 90's but couldn't because of still being underwater. I was trapped when some great opportunities presented themselves and unable to take advantage of them. Several of my friends that were foreclosed on in the early 90's did not have that problem. They rented for a few years, rebuilt their credit, saved up and when those opportunity arose they were able to buy. The end result is that they all ended up far better off than me 5 or 6 years later.

In this cycle I know a few people that are walking away, I know a couple of families doing a loan mod and I know one family that even managed to pull off a short sale. I can guarantee the families doing the loan mods will come out of this worse of than the others.

Let's take a look at what's likely to happen by doing a comparison. We will assume the market is bottoming, it will stay there for 5 years and then start going up at a normal 3% per year. I will assume interest rates remain low but not as low as today (let's say 7% in 5 years). I will assume each bought a home for $500k that's now worth $250k and will be worth the same in 5 years. For ease of comparison we will assume tax and insurance is $600/mo

Family 1, has a 500k ARM and wants to do a loan mod. They get a mod locking the rate at 4% for 5 years. Payments are $2400 plus tax and insurance for a total of around $3000 per month. In 5 years they will have paid $144,000 with little of that being principal. At the end of five years they will still owe $452k and the payments will reset to 7% taking it to $3007/mo, plus tax and insurance for a total of roughly 3600/mo. At the end of 5 years, family # 1 is still $200k upside down, trapped and unable to sell, and unless their income rose they still might be facing foreclosure.

Family #2 also has a $500k loan on a house worth $250k. They however choose to send the keys to the bank and move into a recently purchased foreclosure rental. They rent a similar home for $1800/mo. The net difference in total monthly payments between family 1 and family 2 is roughly $1200/mo. Family 2 saves this $1200/mo and after 5 years has $72k in the bank. After 5 years their credit is good and they can once again buy. They purchase a home similar to family one's home for $250k using 20% down (50K), they finance $200k at 7% for monthly payment of $1350 plus tax and insurance or roughly $1900/mo.

After 5 years both families own similar homes:

Family 1 owes $450k and has a payment of $3600/mo.

Family 2 owes $200k and has a payment of $1900/mo. That's $1700/mo less and they owe $250k less on the home. If they were to apply that extra $1700 to their monthly payments they would pay off the home in about 7 years!!

This comparison is not assuming the worst case. Homes could fall much farther than 50%, interest rates could go much higher than 7%. This is a simplistic comparison but it is probably fairly accurate. It gives a chilling indication of what the banks and the government are trying to do to the unsuspecting homeowners. Many of these people really do think the government and the banks are trying to "help them" stay in their homes. That's just not the case. The government and banks are simply trying to avoid a collapse of the banks. Helping the home owner is the last thing on their minds.

Most people are stunned when they do the math. I've given advice to quite a few people and most of them do see the light. The really amazing thing is that a couple of them still pursued loan mods. Their reasons for doing it were that they really thought the prices would come back. In both cases when I asked they said "they thought in 5 years that the prices would recover and they would be able to sell". Me thinks not....

Phantom inventory

Here's a perfect example of the so called "phantom inventory"

7413 Pebblewood Ct in Riverside. This 3000 s/f home was purchased at the peak for $665k. The lender got it back in August of 2008. They tried to get $417k at the trustee sale but there were no takers at that price so they bought it. The bank has owned this home since Aug 6th, 2008. It just hit the market at the beginning of June! The bank has had this house for 10 months, and are just now getting it on the market.

This makes no sense to me. They certainly would have gotten more for this home a year ago than they will get for it now. Plus the holding costs and misc other costs they have accrued will add to the total loss. It's just stupid for these lenders to hold back the homes. Especially now, the inventory is low and there are some buyers out there.

There's also a pretty good article in the Washington Post on the problem of Phantom Inventory.

Or this story about 15,000 foreclosures that got "lost"??huh.....

From $1.2M to $250K

This might be a record price drop, but then again there's little doubt that the $1.2M sales price of this gem in late 2006 was fraud. 3370 Orange St in downtown Riverside is just a block over from the Mission Inn. It was built over 100 years ago in 1904. It's a little craftsman house with 4 bedrooms and 1.5 baths. Decent looking but certainly nothing special. The location is also not great. It's right across the street from the convention center.

The sales prices of this home are all over the map. It sold in late 2004 for $445k. 2 years later is sells for $1.2 million. Yea, that sale just screams fraud. Less than a year later a $425k sale is listed. That could very well be the bank getting it back, since it was listed for sale again almost immediately. It languished on the market for nearly a year and finally sells again in Sept 2008 for $374k. Someone thinking they were gonna fix and flip possibly?? They listed it again only a month after closing. The price has been dropping ever since. It's currently listed for $248,500. That's $125k less than the sale last year. I really think this was a flip attempt. If so, they are taking a bath on it.

If anyone is doing the math, the current listing price is 80.2% off peak price. And it's 33% less than it was bought for in late 2008.

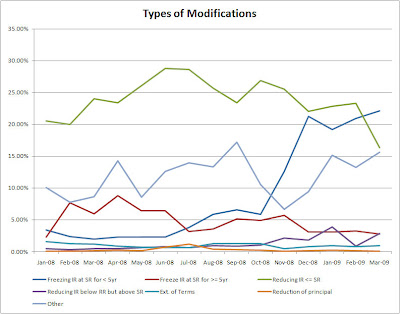

Loan Mods = Tomorrows foreclosures

- IR : Interest Rate - Current Interest Rate for the loan.

- SR : Start Rate or Initial Rate - Initial Interest Rate for the Loan

- RR : Reset Rate - Rate at which the loan will reset

Why wont the loan mods work? The only way a loan mod will work is if the principal balance is reduced to market value. Practically zero of the loans are getting principal reductions. And personally I don't believe any loan should get a principal reduction. Most of the loan mods are simply getting interest rate reductions or freezes at the start rate of the loan or some other favorable rate. A few loans are getting extended terms (this is idiotic). The end result is that the home owners are still stuck miles underwater. Sure they may be able to afford the payments but they are trapped and will never be able to sell. I suppose if the payments are similar to what rent would be, then you could justify it by saying "it's the same as rent". But renters can move!

Many of the loan mods are only freezing or reducing rates for 5 years. Then what? I don't think anyone with half a brain thinks prices will be any better in 5 years. Are the banks going to do another loan mod? We are just turning today's foreclosures into tomorrow's.

Still bleeding jobs

California's unemployment rate climbed to 11.5 percent in May, the highest in modern record-keeping, the U.S. Department of Labor reported Friday. The loss of another 69,000 jobs comes as a blow to the state after unemployment dipped slightly to 11.1 percent in April, according to revised figures. The California Employment Development Department said the government posted the largest job declines in the month, down by 14,200 jobs. Every other sector besides education and health services also saw losses.

Although the Labor Department reported that 48 states and the District of Columbia saw their unemployment rates rise in May, California's rate was substantially higher than the national rate of 9.4 percent for the month.

Only four states had higher rates: Michigan, Oregon, Rhode Island and South Carolina.

The West had the highest regional jobless rate in the nation, at 10.1 percent, and it was the highest rate since September 1983, when the nation was emerging from a deep recession.

..............................

13% and climbing in the IE! Yikes.....

Is the wave here?

Mr Mortgage seems to think the newest foreclosure wave is finally starting to hit..

The wave is here even though it did not show up in the aggregate numbers released by RealtyTrac yesterday morning. In their report, CA aggregate foreclosure activity was reported down 4.46%. That is not accurate.

There are three stages of foreclosure, which we track religiously every day. Because each stage is separated by a period of up to 4-months, the mix can change dramatically causing the aggregate to move in the opposite direction of present conditions. Additionally, back in 2008 most servicers all did things the same way at the same time. Now, each bank and servicer has their own agenda so the monthly numbers are much more volatile, which can lead to misinterpretation.

In May, aggregate foreclosure activity was not down 4.6%, rather up 13.5%. On a more granular level, the takeaways are that Notice-of-Trustee Sales are up 100% from Feb to May and subsequent foreclosures are up 75% from March to May - these are significant events. Especially when considering that the housing market at the low end has been benefiting in part by the lack of inventory caused by the Q4 2008 - Q1 2009 moratoria.So, why aren’t foreclosures up 200% - 300% from March and back to all-time highs, as the March through May Notice-of-Trustee Sales surge would indicate? It’s because of capacity and timing.

We know for a fact the GSE’s and several servicers came off moratorium around the time that Obama made public the Home Affordable mod and refi programs at the end of March. From there the servicers had to make the decision to participate, integrate the new borrower modification and loan decisioning and slotting technology and train staff. If this took 6 weeks, which would be incredibly fast, then in the second week of May they would have started re-qualifying and contacting the back log of distressed borrowers with the new loan mod, workout and refi offers. Then they have to give the borrowers a reasonable time to accept or deny. It is only June 11th — there simply has not been enough time. But early foreclosure numbers for June show the foreclosure ramp remains intact.The Notice-of-Trustee Sales and foreclosures will continue to come. Notice-of-Defaults — the first stage of foreclosure and the earliest leading indicator of everything mortgage, housing and balance sheet related — have been hitting record highs since December.

The past 6-month NOD average is 45k…the 6-month average for the worst time in the summer of 2008 was only 43,500.

The subsequent foreclosures that come from this latest 6-month NOD surge will hit about the same time a mortgage mod re-default surge from the 2008 NOD surge does. At this point if new NOD’s have leveled out or even fallen by 50%, the re-defaults from bad loan mods made when mods were new and even more reckless than today will keep foreclosures as headlines through next Spring at least.

......................................

So, is the next wave starting to hit? Only time will tell. I am still seeing a higher number of properties hitting the market in my target areas. That would seem to indicate the number of foreclosures are starting to increase. The inventory levels are still a little low and the better homes are still selling fast. The 4th quarter of the year should be very telling though.

I be back...... And here's the May numbers

The May numbers from DQ are out. They look pretty good. I was actually expecting a slight increase in the median but that didn't happen. Riverside stayed the same as April and San Berdu fell just a tick. The reason I was expecting an increase wasn't because prices are going up. I felt with the drop in inventory, especially at the low end that might push up the median a bit because of lack of low end sales. It didn't but it was close. The report also mentions this point as a reason for the better numbers.

| | Sales Volume | Median Price | ||||

| All homes | May-08 | May-09 | %Chng | May-08 | May-09 | %Chng |

| Los Angeles | 5,445 | 6,521 | 19.8% | $422,000 | $300,000 | -28.9% |

| Orange | 2,266 | 2,667 | 17.7% | $485,000 | $410,000 | -15.5% |

| Riverside | 3,444 | 4,414 | 28.2% | $290,000 | $180,000 | -37.9% |

| San Bernardino | 2,075 | 3,134 | 51.0% | $250,250 | $137,000 | -45.3% |

| San Diego | 2,979 | 3,242 | 8.8% | $380,000 | $295,000 | -22.4% |

| Ventura | 708 | 797 | 12.6% | $435,000 | $355,000 | -18.4% |

| SoCal | 16,917 | 20,775 | 22.8% | $370,000 | $249,000 | -32.7% |

Southern California home sales rose for the 11th consecutive month in May as sales of $500,000-plus homes started to come back. The median price paid increased slightly from the prior month for the first time since July 2007, the result of a shift in market activity where sales of deeply discounted foreclosures waned and mid- to high-end purchases rose, a real estate information service reported.

A total of 20,775 new and resale houses and condos closed escrow in San Diego, Orange, Los Angeles, Ventura, Riverside and San Bernardino counties last month. That was up 1.3 percent from 20,514 in April and up 22.8 percent from 16,917 a year ago, according to San Diego-based MDA DataQuick.

May’s sales were the highest for that month since May 2006, when 30,303 homes sold, but were 21.2 percent below the average May sales total since 1988, when DataQuick’s statistics begin.

Foreclosure resales – homes sold in May that had been foreclosed on in the prior 12 months – accounted for 50.2 percent of all Southland resales. That was down from 53.5 percent in April and from a peak of 56.7 percent in February. May’s figure was the lowest since foreclosure resales were 50.9 percent of all resales last October.

Last month’s median was the second-lowest for any month since it was $242,000 in February 2002, and it stood 50.7 percent below the peak $505,000 median reached in spring and summer of 2007.

“We appear to be in the early stages of the market gradually tilting back toward a more normal balance of sales across the home price spectrum. As more sellers get realistic, more buyers get off the fence and more lenders offer reasonable terms for high-end purchase financing, we’ll see a more normal share of sales in the more established, higher-cost areas that have been nearly comatose,” said John Walsh, MDA DataQuick president.

“Let’s not forget we’re into the traditional home buying season right now,” he continued, “meaning more people are purchasing for all of the normal reasons, such as a new job or to get settled before school starts. Many are concerned with finding the right home in the right area, not just the most deeply discounted home.” Indicators of market distress continue to move in different directions. Foreclosure activity remains near record levels, while financing with adjustable-rate mortgages is near the all-time low, as is financing with multiple mortgages. Down payment sizes and flipping rates are stable. Non-owner occupied buying has risen and is above-average in some markets, MDA DataQuick reported.

...............................

Worst listing/picture contest

I'll be heading out to sea again tomorrow for a week long vacation with the family. We are off on the Mariner of the Seas to San Fran, Seattle and Victoria B.C.

Rather than silence while I'm gone. Why don't you guys start posting the worst listings you can find. There's plenty of em, so don't be shy. Feel free to post delusional prices, crappy pictures or just plain horrible listings.

You guys behave and have a happy Father's day. I'll be back on the 21st.

The ratings agencies are not very optimistic

The ratings agencies are not very optimistic about home prices. Fitch is looking for an additional 36% in California. Sounds bad but realistic for once. I don't expect another 36% in the IE or even in the median price. But I do expect a big drop in the high end areas that are still defying gravity. South OC, West LA the better area of San Diego and San Fran, etc. Those areas still have a long way to drop. The California Median is still at $221k, a 36% drop would take it down to $142k. That's about where it was in 1987. After the last bubble it bottomed in 1996 at $177k. The reason I don't expect a large fall in the median is that the houses where the big price declines will happen are all at the high end. That could even have the effect of moving the median price up if the high end starts to unfreeze. That would make the number cruncher's heads hurt. Prices tanking and the median going up... Oh wait that already happened in 2007;-)

NEW YORK, Jun 12, 2009 (BUSINESS WIRE) -- Fitch Ratings has taken various rating actions on 543 2005 through 2008 vintage U.S. subprime RMBS transactions in the course of its ongoing review of subprime RMBS.

A spreadsheet detailing Fitch's rating actions on the affected transactions, as well as Expected Loss for each mortgage pool and Loss Coverage Ratios for each bond, is available at www.fitchratings.com under the following headers:

Structured Finance >> RMBS >> Rating Action Reports

....

Today's rating actions reflect Fitch's analysis of expected default and loss from the collateral pool in addition to cash flow analysis of each class. The average updated expected collateral losses as a percentage of the original pool balance for the 2005, 2006 and 2007 vintages are 17%, 39% and 47%, respectively. As a percentage of the remaining pool balances, the average expected losses for the three vintages are 45%, 59% and 55%.

The updated expected collateral losses incorporate performance trends since the last rating revisions which relied on September 2008 remittance data. The projected losses also reflect an assumption that from the first quarter of 2009, home prices will fall an additional 12.5% nationally and 36% in California, with home prices not exhibiting stability until the second half of 2010. To date, national home prices have declined by 27%. Fitch Rating's revised peak-to-trough expectation is for prices to decline by 36% from the peak price achieved in mid-2006. The additional 9% decline represents a 12.5% decline from today's levels.

The home price declines to date have resulted in negative equity for approximately 50% of the remaining performing borrowers in the 2005-2007 vintages. In addition to continued home price deterioration, unemployment has risen significantly since the third quarter of last year, particularly in California where the unemployment rate has jumped from 7.8% to 11%.

Is anything closing?

It's certainly been an interesting and frustrating spring. I'm hoping summer will bring better pickings. So far the new listings are still picking up. This was another really good week in the tracts I watch. Quite a few new listings appeared. Several of them had prices that looked pretty good too. If I weren't taking off on a cruise on Sunday I might have gone and looked at a few of them.

My contacts in the biz still say the banks have boatloads of properties to unload and they still think they will release them soon. I've been hearing this for a couple of months now and I'm starting to think either my contacts are loopy or the banks are.

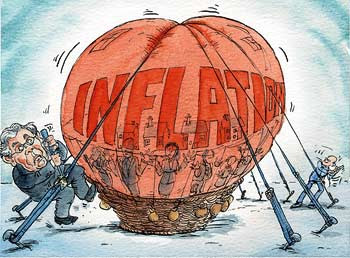

Buying to hedge against inflation?

I've had a few emails asking if buying is a smart hedge against inflation. Their thinking is that if inflation takes off, like many think it will, that will drive prices up. And it eventually will. But during the inflationary period home prices are more likely to go down.

Here's my 2 cents. If you are buying for the VERY long haul in an area where prices are close to the long term trends you should be fine. With today's current low rates, a fixed rate loan can get you a nice comfortable payment. I would not stretch to buy right now. If inflation does take off your monthly expenses would shoot up, so you want a nice cushion. The cost of food, clothing, gas, utilities and nearly everything else is likely to rise significantly over then next decade. Don't worry about that $4 a gallon gas, you'll forget about that when it's $10 a gallon. Sure wages will increase too, but wages lag. When inflation tapers off then wages will catch up over a few years. If you buy, leave yourself some financial wiggle room for inflation.

The down side is if you need to sell during an inflationary period you are likely to get creamed. If inflation takes off then the interest rates will likely skyrocket. Remember the 70s? Interest rates were in the 15% range (really they were!). How much can people afford at 15%? Do you think you could sell a $400k home in the IE if the rates were 15%? The principal and interest alone would be over $5k per month on that note. That pretty much eliminates all buyers making less than $200k a year. High interest rates will either tank prices or tank sales (or more likely both).

Is a house a good hedge against inflation? In my humble opinion, only if you stay in it and can easily afford the payments. It's certainly a good hedge against rising rents!

Crashing through "fair market"

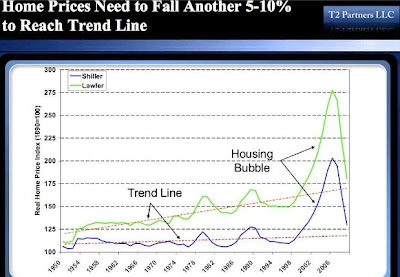

House prices are finally approaching fair value. Unfortunately, unless the housing bubble behaves differently than almost every bubble before it, house prices will now crash right through fair value and stay below it for a number of years.

When prices do finally bottom, moreover, they aren't likely to recover quickly.

We think housing prices will reach fair value/trend line, down 40% from the peak based on the

S&P/Case-Shiller national (not 20-city) index, which implies a 5-10% further decline from where

prices where as of the end of Q1 2009. It’s almost certain that prices will reach these levels.

• The key question is whether housing prices will go crashing through the trend line and fall well below fair value. Unfortunately, this is very likely.

In the long-term, housing prices will likely settle around fair value, but in the short-term prices will be driven both by psychology as well as supply and demand. The trends in both are very unfavorable.

– Regarding the former, national home prices have declined for 33 consecutive months since their peak in July 2006 through April 2009 and there’s no end in sight, so this makes buyers reluctant – even when the price appears cheap – and sellers desperate.

– Regarding the latter, there is a huge mismatch between supply and demand, due largely to the tsunami of foreclosures. In March 2009, distressed sales accounted for just over 50% of all existing home sales nationwide – and more than 57% in California. In addition, the “shadow” inventory of foreclosed homes already likely exceeds one year and there will be millions more foreclosures over the next few years, creating a large overhang of excess supply that will likely cause prices to overshoot on the downside, as they are already doing in California.

• Therefore, we expect housing prices to decline 45-50% from the peak, bottoming in mid-2010

• We are also quite certain that wherever prices bottom, there will be no quick rebound

• There’s too much inventory to work off quickly, especially in light of the millions of foreclosures over the next few years

• While foreclosure sales are booming in many areas, regular sales by homeowners have plunged, in part because people usually can’t sell when they’re underwater on their mortgage and in part due to human psychology: people naturally anchor on the price they paid or what something was worth in the past and are reluctant to sell below this level. We suspect that there are millions of homeowners like this who will emerge as sellers at the first sign of a rebound in home prices

• Finally, we don’t think the economy is likely to provide a tailwind, as we expect it to contract the rest of 2009, stagnate in 2010, and only then grow tepidly for some time thereafter.

How much underwater could you live with?

Most of the readers of this blog are interested in buying a home. I'm wondering how much of a drop in value can you live with? I know 3 people that have bought homes since late last year. All of them thought the market was at the bottom. Obviously it wasn't and all 3 of them now have homes worth less than they paid.

Home #1, purchased in Late Nov for $485k. Two recent sales of identical homes $424k and $440K. This buyer has already seen his DP money vanish and then some. If he had to sell he'd be looking at an additional loss of around $30k after fees. He's not selling but I know he is uneasy about his new home being worth 50K less than he paid for it 8 months ago. Plans for a pool are now on hold.

Home 2, Purchased in Jan for $235k. Recent listings/sales of similar homes are priced from $199k to $229k. His 10% DP is probably already lost. A forced sale would also leave him in a pickle. He's not worried since his payment is less than his rent was. Working at the post office his job is probably pretty safe so he should have no worries.

Home #3, They closed in Feb for $360k. Recent listings and sales for similar sized homes are in the $269k to $329k. Nothing over $320k has closed in the last 2 months. They don't seem too concerned which is scary since I know they are only planning on staying in this house for around 5 years. These folks actually think this house is going to go up in price in that time frame. I suppose it's possible, just like it's possible that earth will stop rotating next week. They seem oblivious to the fact that they are now at least $50k under water.

I plan on being in my next place 20+ years so for me being 10% or so underwater is no big deal. I can live with that. But could I live with 20% or 30%? Dunno, doesn't sound like much when you say 20 or 30%. But that's around $100k for the homes I'm looking at, factor in interest over the loan and it's closer to $300k. I know some of the houses I was very interested in early last year are now worth far less than they sold for. One home I liked sold for $525k. Recent comps sold for $420k and $415k. Kinda makes you take a step back, huh!

Obviously a lover of the arts.....

This isn't a delusional seller post (although he is). I was looking to make such a post when I ran across this home. The home is at 9130 Hunt Rd in South Corona. I see it when I play Trilogy Golf Club. It sits on a hill behind the 12th hole. This house has been on the market for ages. It first listed in Jan 2008. He's been dropping the price but with an asking price of $2.2M he will need to make some serious price cuts before this place gets any interest. It's a nice property but he's probably at least 50% too high.

But the reason I picked the house is the decor. It's not horrid or anything just some of the paintings caught my eye. Like the Mona Lisa for instance, that is hanging in the living room. Or Washington Crossing the Delaware by Leutze, that is hanging over the fireplace. And if you look closely you will see another pic of George on the wall across from that (looks to be a copy of the one by Gilbert Stewart).

I dunno why, but those paintings just made me chuckle.

Finally, Happy Birthday to Mrs. X, who turns 29 for the 14th time tomorrow.

Are the flood gates cracking open??

Are the flood gates cracking open? In the last 3 days there have been more new listings post in my search area than there was in the last month. I'm hoping this is an indication that the banks are finally starting to release that inventory they are supposed to be sitting on. I will contain my enthusiasm for a while just to see if this is a fluke week or not.

Smoking the dream pipe......

Time for another delusional seller post.

12710 Canyonwind Rd is in the Orchard Estates tract off La Sierra blvd in Riverside. This is a nicer tract with most of the homes being built between late 80's and late 90's. This one says it was built in 2001, which seems odd since there is a sale listed in mid 2000.

The home is big and has all the bells and whistles. It's almost a poster child for over-upgrading. It has an awesome pool, it's own sand beach area (real sand), a pond, a fake grass golf hole, a theater, a trendy kitchen and built-ins galore. It's really a beautiful house, even if over cooked a bit. The house is 4799 s/f with 6 bedrooms and 4 baths. It sits on a nice 3/4 acre lot too. It has everything except a reasonable price.

I was looking at a very similar home about 6 months ago in the same area. Granted it was not as nice as this but it wasn't far off. Asking price of that one was $499k. There are two nearby homes listed in the mid to high 500s. Again they are not nearly as nice as this home and they are a bit smaller. But how much is all that stuff worth? $100k?, $200K? to some folks it's not worth anything. Who needs a pond, that sand beach just attracts the neighborhood cats to the biggest litterbox in Riverside. A theater, that's cool but it's mostly just a waste of space. Let's face it anyone who puts a theater in their house is just trying to impress their friends.

So what do you think he is going to get for his home? (keeping in mind the comps are in the $500k to $600k range. Actually, Redfin shows nothing selling for over $530k in this tract in the last year.

Would you like to see what the delusional owner thinks his version of Xanadu is worth? Brace yourself and swallow any liquids you may have just sipped. This dude thinks he can get $1.6 Million! Yes when the highest sale in the last year in his tract is $530k this guy asks for TRIPLE that. Who says hope is dead?

| Low | mid | High | |

Zillow Zillow | $404,670 | $493,500 | $537,915 |

Eppraisal Eppraisal | $355,117 | $417,785 | $480,452 |

Cyberhomes Cyberhomes | $319,869 | $355,410 | $408,721 |

We salute you, over upgrading-delusional seller guy. for without you, I would have nothing to write about tonight......